2020 was a monumental year for trade relations between Mexico and the United States, strengthening an already booming ecosystem with anywhere from seven to 11 million truckloads of goods making the crossing each year. In fact, according to the Office of the US Trade Representative, as of 2019, Mexico became the US’ largest goods trading partner with $614.5 billion in total goods traded. This trend is expected to continue for years to come as experts name tension with China, new trade agreements, and the effects of the COVID-19 pandemic as key factors for companies pushed to rethink their supply chains. As such, Mexico stands out as the natural alternative to reduce costs and logistical constraints.

As the world settles into post-pandemic normalcy, what can be expected for the future of US-Mexico trade?

Can Mexico become the new China?

Even before the pandemic hit, consulting firm Gartner found that 33% of global supply-chain leaders had either shifted sourcing and manufacturing activities out of China, or planned to do so in the next three years. Mainly driven by increasing tariffs accentuated during the Trump administration, supply chain leaders were forced to question the effectiveness of heavily outsourced networks so far from the final consumer. The pandemic then reinforced the need for more resilient processes with the agility to shift around sourcing, manufacturing and distribution activities quickly. And so, the rise of the regional supply chain began to gain traction with Mexico positioned as the lead alternative to ease delays and shortages in times of uncertainty.

On top of an already shaky ground for US-China relations, Mexico's position benefited from the signing of the USMCA agreement in favor of the old NAFTA. The new agreement aims to bring manufacturing back to North America by decreasing or eliminating tariffs to reduce costs of production and trade, leading to lower prices for the final consumer and more profit for companies. The move south of the border also means stricter labor, environmental, and privacy regulations, faster and more accurate shipping times, and an array of logistical efficiencies linked not only to Mexico's privileged geographical position, but also to a more familiar cultural landscape.

Embracing a digital world

Digitalization has been a long-standing trend across industries for a while, but there is no denying that the pandemic helped surpass even the most ambitious forecasts. In fact, a study by fintech EBANX shows the major impact of the pandemic on the adoption of digital channels in LATAM. According to the study, Mexico's online consumers grew by 31% in 2020, the largest increase in the region, and a jump that, normally, could only be achieved by 2022.

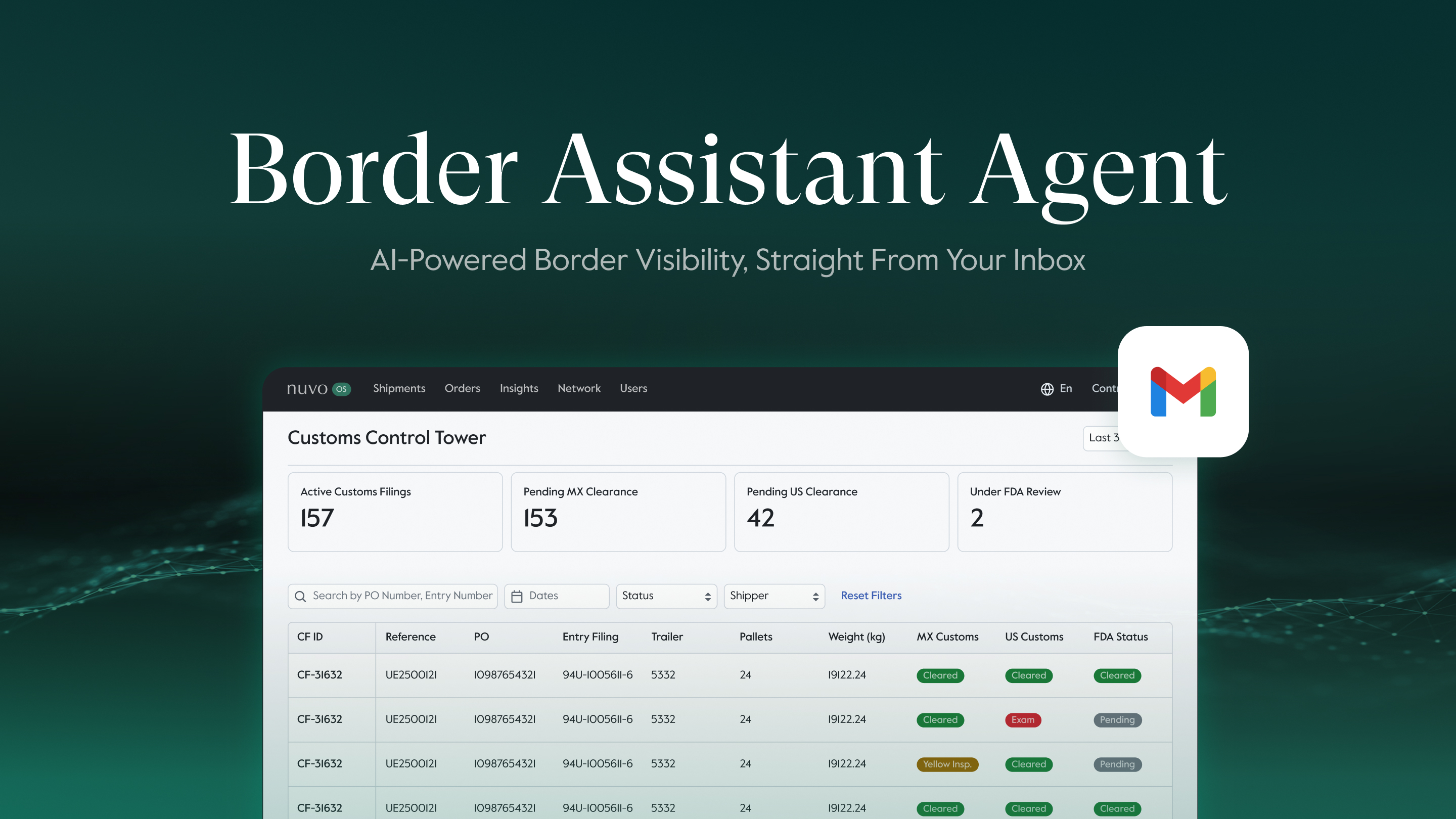

This shift towards a more digital ecosystem is also reflected in the logistics industry. Only 12 years ago, around 90% of shippers refused to accept PODs in digital format. Today, as a result of COVID and the proliferation of remote work, we've seen that 98% of our clients prefer this format. And documentation is only the beginning of a long road to optimizing supply chain processes. Technology has brought great improvements in areas such as tracking and visibility, through GPS and electronic logging devices (ELDs), raising the bar for service providers in the industry. Real-time visibility, customs, shipment tracking, geolocalization, data and predictive analytics tools have gone from exclusive perks to must-haves as digital-native customers increase, and productivity and efficiency concerns rise to the forefront of the very cost-heavy logistics department. Thus, the next 10-15 years are set to be a turning point for a very traditional industry that still relies heavily on analog processes.

The effects of changing politics

So far, current operations indicate that the USMCA and trade will not be affected by the new Biden administration, as it is pinned to bring more stability and predictability to trade relationships. Although the treaty was signed during a Republican presidency, the democratic government led by Biden is expected to promote commercial relationships with Mexico and Canada in order to maintain and strengthen ties with neighboring countries. Additionally, an expected increase in US government spending and a policy refocus on middle and lower classes could also prove beneficial to Mexico’s production capabilities, as additional consumption incentives are created.

After a year full of challenges and rapid changes, excitement is mounting around the endless opportunities surrounding US-Mexico trade. We expect 2021 to be a marquee year for Mexican industries, as companies of all sizes expand their reliance on Mexican production by bringing their supply chains closer to home.

Originally published in Mexico Business Week.