Do you have questions about the Bill of Lading supplement? Nuvocargo gives you answers! Being just days away from entering the trial period of the Bill of Lading supplement and the regulations issued by the Mexican tax authorities, shippers and carriers in Mexico are seeking to clarify their doubts in order to prepare. The consequences of non-compliance imply large costs that companies not only want to avoid, but to deal with efficiently and transform into a competitive advantage. Below, find answers to the key questions that impact everyone involved in the movement of cargo within and into the country.

What are the new regulations?

The Miscellaneous Tax Resolution for the year 2021 helps us to consult the updated general rules, issued by Mexican Tax Authorities. This is of great relevance for all those who are carriers, transport agents and/or intermediaries/brokers of truck transport, maritime, air, and rail transport. As of this resolution, Mexican carriers that provide cargo transportation services must comply with the issuance of the following documents: Income / Transfer invoice and Bill of Lading supplement issued prior to the start of transportation.

What are the objectives of this initiative?

The Mexican Tax Authorities estimate that 60% of the cargo in the country could be contributing to smuggling, and is now taking certain measures that will involve more time and coordination for Carriers, Shippers and Intermediaries.

What are the consequences of non-compliance?

The Miscellaneous Tax Resolution for the year 2021 establishes new requirements that will apply as of January 1st, 2022 and non-compliance could result in fines, penalties, operational delays, and the seizure of cargo.

Who is fined for errors or discrepancies?

In the event that a cargo transfer service is carried out without having the invoice with a Bill of Lading supplement, or the supplement does not comply with the provisions of the "Standard of the Bill of Lading supplement" and the "Instructions for filling out the invoice incorporated to the Bill of Lading supplement” published by the Mexican Tax Authorities, both the shipper and carrier may be subject to fines and other penalties provided for in the applicable regulations.

For carriers:

Who should issue the income invoice with Bill of Lading supplement?

The income invoice with Bill of Lading supplement must be issued by the transport service provider, when it has been contracted for the transfer of cargo within national territory.

Is it necessary to issue the income invoice with Bill of Lading supplement to be able to prove its transfer in national territory?

Yes, you must issue the income invoice with the Bill of Lading supplement and generate the printed representation, on paper or in digital format, to prove the possession and transfer of the goods and/or merchandise in national territory.

For the purposes of filling out the Bill of Lading supplement, is it required to register the data of the driver(s) or operator(s) of the transport units?

Yes, it is necessary to record the following data:

- Code number in the RFC of the driver or operator (in case of being from Mexico).

- License number.

- Tax identification registration number of the operator (in case of being a foreigner).

- Tax residence of the operator (in case of being a foreigner).

For shippers:

Who should issue the transfer invoice with Bill of Lading supplement?

The transfer invoice with Bill of Lading supplement must be issued by:

- The owner, as well as the holders or holders of the merchandise/goods that are part of his assets, when these are transferred by their own means; and

- The intermediary or broker, who provides logistics services for the transfer of cargo, or has a mandate to act on behalf of the client, when the transfer is carried out by their own means.

If I contract transportation services to move goods/merchandise and the invoice issued by the carrier does not contain the Bill of Lading supplement, can I make the service deductible?

Starting December 1st, 2021, goods/merchandise transportation services cannot be deducted with an income invoice without a Bill of Lading supplement, for not meeting the requirements of tax deductions. The foregoing is not applicable to services performed by carriers that fall under the assumption referred to in rule 2.7.1.52., first paragraph of the current Miscellaneous Tax Resolution.

About when it applies:

If I am dedicated to the transfer of goods/merchandise locally, that is, I do not transit by federal highway, should I issue the invoice with Bill of Lading supplement?

No, taxpayers who provide general and specialized cargo motor transport service, without the transfer implying passing through any section of federal jurisdiction, may issue an income invoice without a Bill of Lading supplement, which contains the requirements established in Article 29-A of the CFF, in which you register the product and service key defined in the “Instructions for filling out the invoice to which the Bill of Lading supplement is incorporated”, which the Mexican Tax Authorities publish on their portal for this purpose.

I provide the goods/merchandise transfer service and the route that I will follow is only for local transit, am I obliged to issue the entry invoice with Bill of Lading supplement?

No, carriers that provide goods/merchandise transfer services and have full security that they will not travel on federal highways, may issue an income invoice without the Bill of Lading supplement, in which they register the product and service key, contained in the “Instructions for filling out the invoice incorporated to the Bill of Lading supplement”, published on the portal of the Mexican Tax Authorities.

About errors or discrepancies in the documents:

What should I do if derived from are turn of merchandise, discount, change of route, loss of product or some other situation, the final price of the trip is different from the one reported in the initial income invoice with Bill of Lading supplement?

If the price of the transport service is higher, you will have to issue a debit note (income invoice without Bill of Lading supplement), having to relate the initial invoice with the type of relationship 02 "Note of debit of the related documents". If the price of the transport service is lower, you will have to issue a credit note (transfer invoice), having to relate the initial invoice with the type of relationship 01 "Credit note of the related documents".

On how to prepare:

In the free billing services offered by the Mexican Tax Authorities, will the option to issue receipts of the income or transfer invoice with Bill of Lading supplement be enabled?

Yes, the corresponding update is being worked on.

What is the format of the invoice with Bill of Lading supplement that will serve to prove the transport and the legal stay and/or possession of the goods and/or merchandise in national territory?

The printed representation, either on paper or in digital PDF format or some other legible format that allows validating the required information of the Bill of Lading supplement, will serve to prove the transport, as well as the legal stay and/or possession of the goods and/or merchandise during their transfer in national territory.

What systems will be used to issue Bill of Lading supplement? Which ones already do?

The Mexican Tax Authorities communicated that they will enable the option to issue receipts of the income or transfer invoice with Bill of Lading supplement in the free billing services they offer. Likewise, there are several companies that currently offer invoice issuance services and will offer the service of issuance of Bill of Lading supplement.

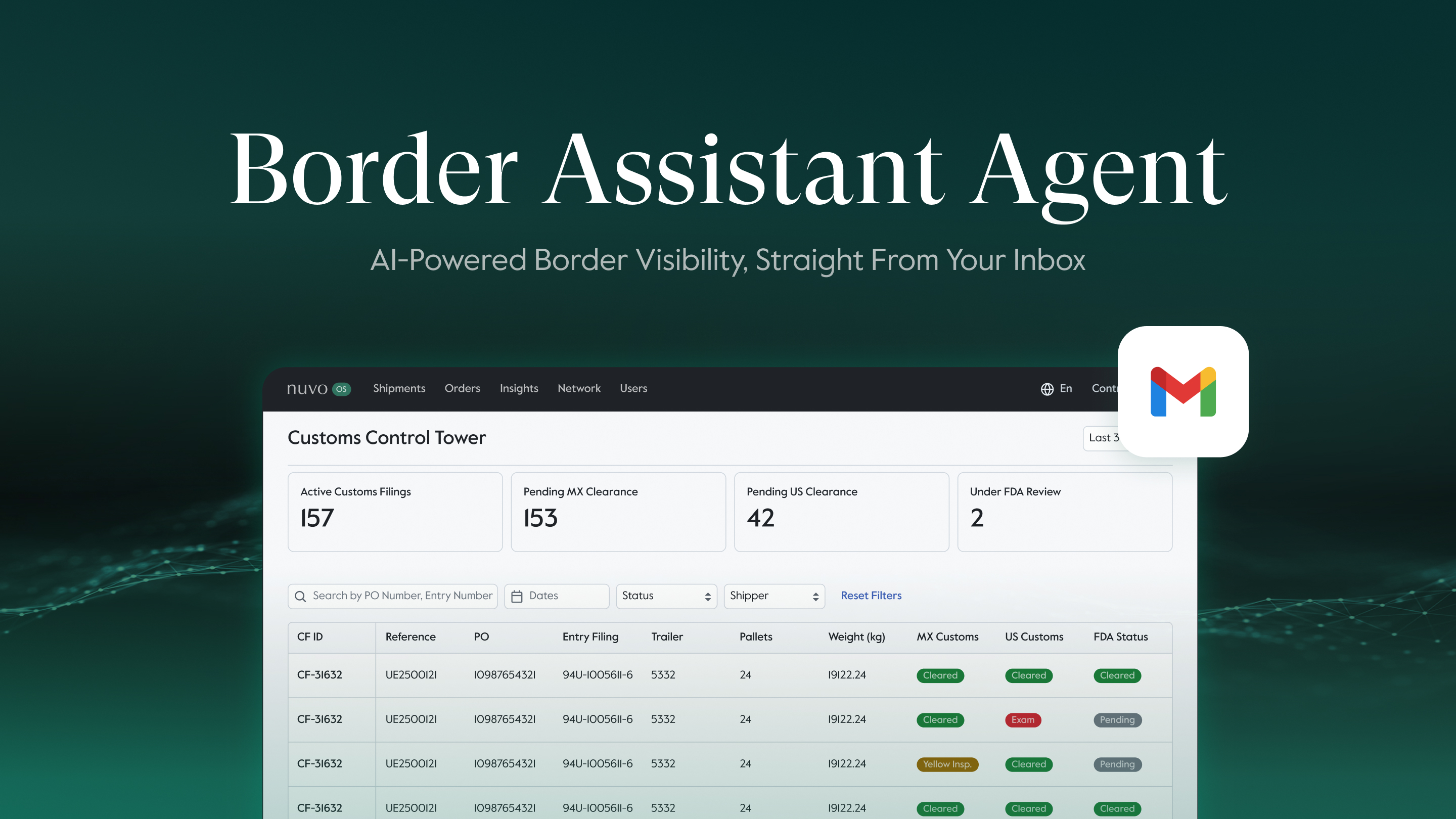

What is Nuvocargo doing to help its clients and partners in this transition?

We currently have pilots running for the efficient management of information flow with our clients, and training our carriers to streamline and comply with regulations and processes. In addition, we are making investments in our platform to provide visibility into compliance and historical record of documents in a timely manner.

Do you still have doubts? If you want to see the webinar on-demand, click here. You can also see more responses from the Mexican Tax Authorities about the Bill of Lading supplement by clicking here.

At Nuvocargo, we work for you.

Let's keep moving together!